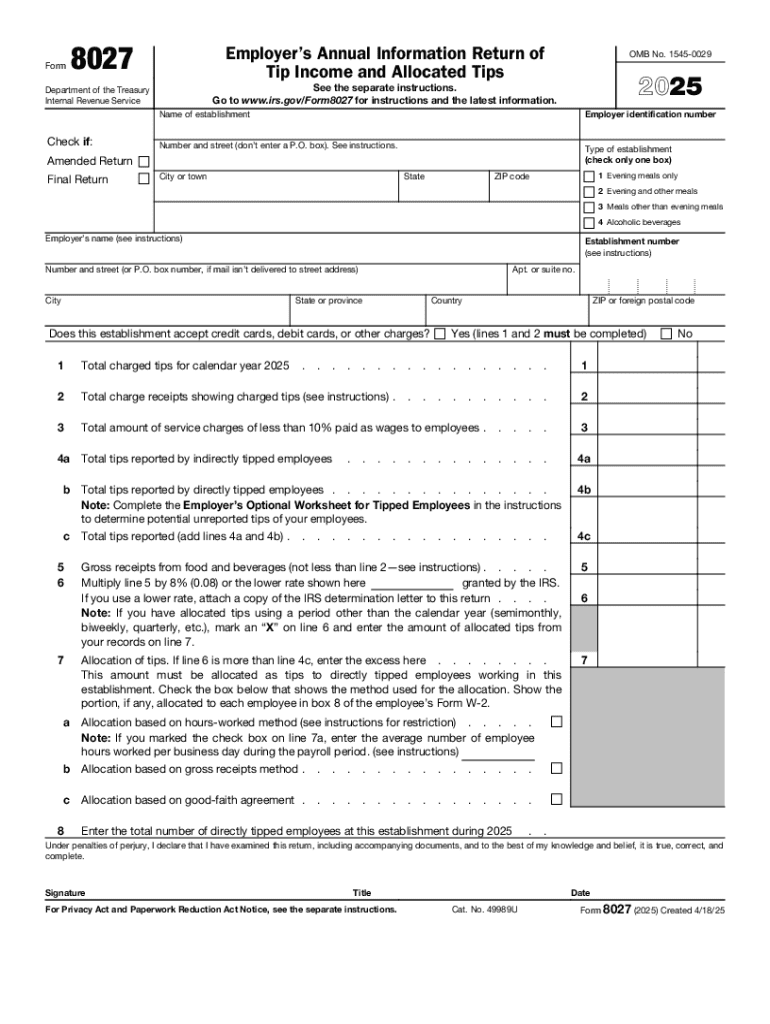

IRS 8027 2025-2026 free printable template

Instructions and Help about IRS 8027

How to edit IRS 8027

How to fill out IRS 8027

Latest updates to IRS 8027

All You Need to Know About IRS 8027

What is IRS 8027?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8027

What should I do if I find an error on my submitted IRS 8027?

If you discover an error on your submitted IRS 8027, you should file an amended version of the form as soon as possible. It's important to clearly mark the amended form and include any pertinent information that corrects the original filing. Additionally, retain copies of both the original and amended submissions for your records.

How can I check the status of my IRS 8027 submission?

To verify the status of your IRS 8027 submission, you can use the IRS e-file service to track your filing. If you submitted by mail, you may want to wait a few weeks and then contact the IRS directly for confirmation, as processing times can vary. Keep your filing confirmation handy for reference when you inquire.

What should I do if my e-filed IRS 8027 is rejected?

If your e-filed IRS 8027 is rejected, review the rejection codes provided by the IRS to understand the issue. Correct the errors as indicated and resubmit your form. Ensure that all necessary information is accurate and complete, as common mistakes can lead to rejection.

How long should I retain records related to my IRS 8027?

You should retain records related to your IRS 8027 for at least three years from the date of filing. This period allows you to respond to any potential IRS inquiries or audits. It’s also advisable to keep any related documents, such as payment records or correspondence, in a secure location.

Is it acceptable to use an e-signature when submitting IRS 8027?

Yes, under certain circumstances, the IRS accepts e-signatures for IRS 8027 submissions, particularly for electronic filings. Ensure that your e-signature meets the IRS's criteria for authenticity. If you are submitting a paper form, a handwritten signature is typically required.

See what our users say